Current predictions

At the risk of being wrong, I would like to make a prediction by what my software is telling me so far when it comes to this new quarter we have entered in 2022. That being said, let's have a look at our portfolio and see what the market is telling us.

As of the writing of this post, I feel confident in the fact that my automated software has made a few good predictions in the past, and often has a tendency to remain profitable regardless of where the market is going.

To those of you who are new to our forum, I would like to begin by stating that what we are explaining in this post is what the software is doing and what its approach is for the current market we are in, looking into a potentially profitable second quarter and making sure that our software is working correctly allows us to make more accurate predictions (and corrections) in the future. As some of you may know, our software has had months where we are in the red, this however is perfectly fine and is to be expected as we continue to calibrate the variables that determine the conditions for our software to adapt.

First things first

Disclaimer: I am NOT a CPA, nor am I licensed to issue any kind of financial advice, therefore the contents of this post are purely for educational and entertainment purposes only, and should be taken with a grain of salt.

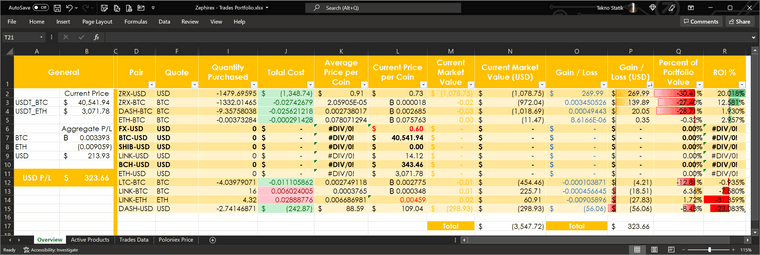

Ok, with that disclaimer out of the way, we now have sorted everything by column P which is Profits/Loss (USD).

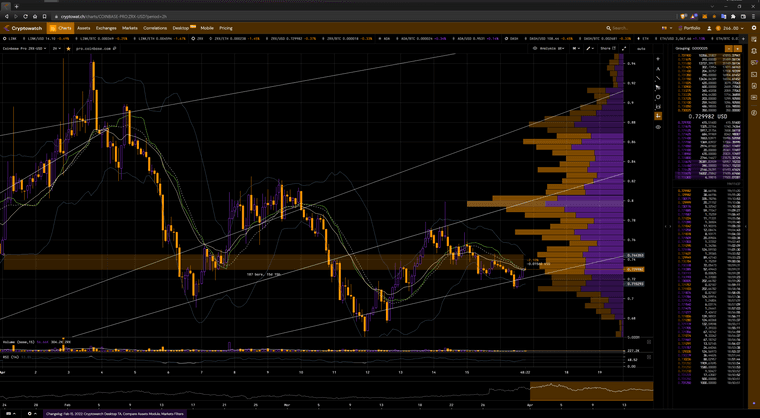

The first thing to notice is how we are in the profits overall by a factor of $320.00USD in just 16 days, next thing to note is that our quantities purchased are in mostly in the negative, currently ZRX is our biggest gainer and are in the 20% profit for our best gainer against the USD. Let's compare the pairs that are in the green to see how they stack up in the future using our handy-dandy retracement fan.

Strangely enough, the markets have taken a downturn yet our software has not heavily bought in, this may be due to the fact that we have made deposits and withdrawals accordingly to secure and make available funds.

Personally, I first felt bullish on this one, but when we see what's underneath that support there isn't a whole lot going on and may be what we here consider to be a bubble. Essentially there is nothing there so as prices continue to fall they trigger stop-loss orders forcing the price to dip lower, thus creating a vicious cycle of triggering more and more stop-loss orders to fulfill. Same thing that happened with GameStop except it may not be the exact same scenario here.

Conclusion

In any case, it may be too early to tell, although to be fair my robot is at the ready if the price drops and buy back into the pair. With that in mind, for the price of ZRX-BTC to drop, then BTC needs to perform well against the dollar, but also if our software is correct, then the USD may also have to recover from its' inflation problem. Mining issues have always caused BTC to go up so relatively speaking the USD has to deflate and miners would have to struggle somehow (perhaps a hike in difficulty?)

As I claimed before, this pair looks rather bullish in the short-term but could be a decoy, we'll continue to monitor the situation and do a follow-up post.