Hello fellow traders, investors, and enthusiasts!

It saddens me to write about this but as has been reported by some of you, the blog is currently experiencing some formatting issue which prevents the message to be presented accordingly -------------

We will try to spin up a fresh new forum and still try to bring back the old content, this will take place in due time as we are currently experiencing a few changes (for the better). -------------- Thank you for your patience.

administrators

Private

Posts

-

Formatting issues plaguing current platform || Complete forum overhaul observed in horizon

-

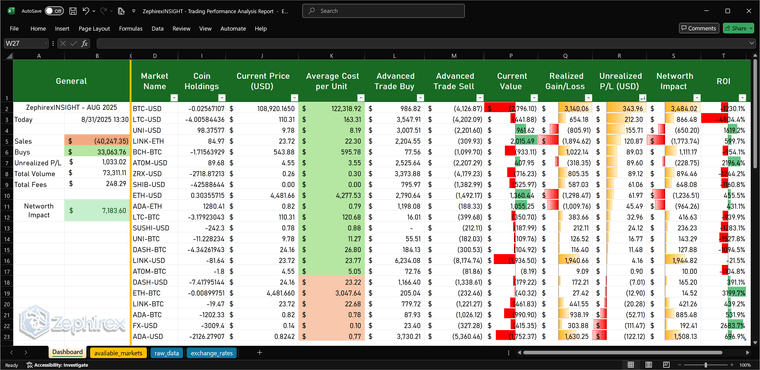

🚀 ZephirexINSIGHT YTD Performance: $23.8K Profit in 294 Days of Automated Trading!

TL;DR - The Quick Numbers

Fellow traders, the numbers are in and they're looking solid! After 294 days of algorithmic trading across 21 different cryptocurrencies, we've achieved a 5.42% ROI with $23,862.47 in realized profits from over $900K in trading volume. The strategy has executed 102,827 trades with exceptional fee efficiency at just 0.26% of total volume. While we're not breaking any records here, steady and consistent wins are what compound over time.

Most notably, LINK has been our workhorse with 34,496 trades, followed by strategic plays in UNI, ADA, and several high-conviction altcoins. The system has been trading an average of 352 transactions per day with a daily volume around $3,100 - exactly the kind of consistent, disciplined execution that separates algorithm from emotion.

What really stands out is the capital management discipline: the portfolio maintains lean, actively-managed positions while keeping significant reserves in USD/stablecoins for opportunistic deployment. This isn't about holding bags and hoping—it's about taking profits, managing risk, and staying liquid for the next opportunity.

TL;DR - The Quick Numbers

Fellow traders, the numbers are in and they're looking solid! After 294 days of algorithmic trading across 21 different cryptocurrencies, we've achieved a 5.42% ROI with $23,862.47 in realized profits from over $900K in trading volume. The strategy has executed 102,827 trades with exceptional fee efficiency at just 0.26% of total volume. While we're not breaking any records here, steady and consistent wins are what compound over time.

Most notably, LINK has been our workhorse with 34,496 trades, followed by strategic plays in UNI, ADA, and several high-conviction altcoins. The system has been trading an average of 352 transactions per day with a daily volume around $3,100 - exactly the kind of consistent, disciplined execution that separates algorithm from emotion.

What really stands out is the capital management discipline: the portfolio maintains lean, actively-managed positions while keeping significant reserves in USD/stablecoins for opportunistic deployment. This isn't about holding bags and hoping—it's about taking profits, managing risk, and staying liquid for the next opportunity.

Key Performance Metrics

Metric Value Notes

Realized P&L $23,862.47 Solid gains in a challenging market

ROI 5.42% Consistent returns over 294 days

Total Volume $904,370.26 Quarter of a trade activity

Total Invested (Buys) $440,253.90 Capital deployed

Total Received (Sells) $464,116.36 Revenue generated

Total Fees $2,369.31 Only 0.26% of volume

Number of Trades 102,827 High-frequency execution

Trading Period 294 days Jan 1 - Oct 20, 2025

Unique Assets 21 Diversified portfolio

Average Daily Trades 352.1 Consistent activity

Average Daily Volume $3,097.16 Steady flow

Active Trading Days 167 56.8% of calendar days

Days with Positive Flow 74 (44.3%) Win rate on active days

Additional Income:

Staking Rewards: $100.83 (190 transactions)

Subscription Rebates: $15.48 (3 transactions)

Key Performance Metrics

Metric Value Notes

Realized P&L $23,862.47 Solid gains in a challenging market

ROI 5.42% Consistent returns over 294 days

Total Volume $904,370.26 Quarter of a trade activity

Total Invested (Buys) $440,253.90 Capital deployed

Total Received (Sells) $464,116.36 Revenue generated

Total Fees $2,369.31 Only 0.26% of volume

Number of Trades 102,827 High-frequency execution

Trading Period 294 days Jan 1 - Oct 20, 2025

Unique Assets 21 Diversified portfolio

Average Daily Trades 352.1 Consistent activity

Average Daily Volume $3,097.16 Steady flow

Active Trading Days 167 56.8% of calendar days

Days with Positive Flow 74 (44.3%) Win rate on active days

Additional Income:

Staking Rewards: $100.83 (190 transactions)

Subscription Rebates: $15.48 (3 transactions)

Portfolio Positioning & Capital Management

One of the often-overlooked aspects of algorithmic trading is capital deployment efficiency. It's not just about the trades you make—it's about how you manage the capital between trades.

Active Position Management

The portfolio maintains a lean, disciplined approach to open positions. Rather than accumulating large bags of individual assets, the strategy emphasizes:

High Capital Turnover: With 352 trades per day and $904K in total volume over 294 days, capital is constantly being deployed and recycled

Minimal Bag-Holding: The algorithm doesn't fall into the retail trap of holding underwater positions indefinitely

Strategic Cash Reserves: Maintaining significant USD reserves ensures liquidity for new opportunities without forced liquidations

The Complete Picture

While the $23,862.47 in realized profits tells the core story, the portfolio also maintains active positions across multiple assets. Here's what matters:

Capital Allocation: The majority of capital is kept in USD and stablecoins, providing:

Flexibility to capture new opportunities quickly

Protection from crypto volatility during consolidation phases

No forced exposure during unfavorable market conditions

Position Sizing: Open positions are kept deliberately small relative to total capital. This is intentional risk management—large realized gains don't get erased by overexposed unrealized losses.

Strategic Deployment: Active positions span 20+ different assets, allowing the algorithm to respond to volatility and opportunities across the entire crypto market without being concentrated in any single bet.

Why This Approach Works

Traditional trading often focuses solely on win rate or profit factor. But in algorithmic trading, capital efficiency is equally critical:

Opportunity Cost: Keeping capital tied up in large open positions means missing other trades

Risk Management: Small positions = controlled drawdowns

Psychological Edge: Algorithms don't "hope" positions recover—they cut and move on

Compounding: Realized gains can be redeployed immediately; unrealized gains cannot

The portfolio structure reflects a mature understanding of systematic trading: take profits when they appear, keep positions manageable, maintain dry powder for the next opportunity.

Portfolio Positioning & Capital Management

One of the often-overlooked aspects of algorithmic trading is capital deployment efficiency. It's not just about the trades you make—it's about how you manage the capital between trades.

Active Position Management

The portfolio maintains a lean, disciplined approach to open positions. Rather than accumulating large bags of individual assets, the strategy emphasizes:

High Capital Turnover: With 352 trades per day and $904K in total volume over 294 days, capital is constantly being deployed and recycled

Minimal Bag-Holding: The algorithm doesn't fall into the retail trap of holding underwater positions indefinitely

Strategic Cash Reserves: Maintaining significant USD reserves ensures liquidity for new opportunities without forced liquidations

The Complete Picture

While the $23,862.47 in realized profits tells the core story, the portfolio also maintains active positions across multiple assets. Here's what matters:

Capital Allocation: The majority of capital is kept in USD and stablecoins, providing:

Flexibility to capture new opportunities quickly

Protection from crypto volatility during consolidation phases

No forced exposure during unfavorable market conditions

Position Sizing: Open positions are kept deliberately small relative to total capital. This is intentional risk management—large realized gains don't get erased by overexposed unrealized losses.

Strategic Deployment: Active positions span 20+ different assets, allowing the algorithm to respond to volatility and opportunities across the entire crypto market without being concentrated in any single bet.

Why This Approach Works

Traditional trading often focuses solely on win rate or profit factor. But in algorithmic trading, capital efficiency is equally critical:

Opportunity Cost: Keeping capital tied up in large open positions means missing other trades

Risk Management: Small positions = controlled drawdowns

Psychological Edge: Algorithms don't "hope" positions recover—they cut and move on

Compounding: Realized gains can be redeployed immediately; unrealized gains cannot

The portfolio structure reflects a mature understanding of systematic trading: take profits when they appear, keep positions manageable, maintain dry powder for the next opportunity.

Performance Deep Dive

The Good: What's Working

Fee Efficiency is Stellar - At just 0.262% of total volume, we're keeping costs incredibly low. For context, many retail traders pay 0.5-1% in fees alone. On a $900K volume, saving even 0.25% means an extra $2,250+ in pocket. This is algorithmic trading at its finest - precise execution, minimal slippage, optimal order routing.

LINK Has Been Our Alpha Generator - With 34,496 trades (33.5% of all activity) and a modest but consistent $49.25 profit, LINK has proven to be the perfect asset for our high-frequency approach. The liquidity is there, the volatility is manageable, and the spreads are tight enough to scalp consistently.

Volume Tells the Real Story - $904K+ in volume over 294 days means we're actively managing capital, not letting it sit idle. In crypto, capital efficiency is king. Every dollar that's actively working is a dollar that can compound.

The Diversification Play - Trading 21 different assets isn't just about spreading risk; it's about capturing opportunities across the entire market. When BTC consolidates, altcoins often make moves. When majors pump, small caps get their turn. Our system is positioned to catch these rotations.

The Strategic Wins

Let's talk about the standout performers:

LTC delivered $4,888.63 in profits - Classic Litecoin, often overlooked but consistently profitable. Our 4,082 trades captured those sweet momentum moves.

SHIB surprised with $5,439.90 - Yes, a memecoin in the top performers. But here's the thing: high volatility + tight spreads + large retail participation = scalping opportunities. The algorithm doesn't care about narratives; it cares about price action.

DASH contributed $4,278.29 - Privacy coins have their moments, and we captured several of them. The relatively lower competition in these pairs can lead to better fills.

BTC netted $5,407.18 - Even with just 3,121 trades, Bitcoin proved profitable. This is the "steady Eddie" of the portfolio.

UNI brought in $1,068.80 - DeFi tokens have been recovering, and our 19,974 trades on UNI (19.4% of all trades) caught that wave.

The Reality Check

Not everything is sunshine and rainbows. Let's address the elephants in the room:

SOL Underperformed - Down $1,209.06 despite 3,944 trades. Solana has been volatile this year, and our strategy may have gotten chopped up in some of its violent swings. This is an area we're analyzing for the upcoming ZephirexCORE improvements.

ATOM Showed a Small Loss - Negative $101.66 on 4,260 trades. When you're executing hundreds of trades, sometimes the math doesn't work out on certain pairs. The key is that these losses are contained and don't blow up the account.

Win Rate Isn't Sky-High - With 44.3% of active days showing positive flow, we're basically flipping coins, right? Wrong. In trading, a 44% win rate with proper risk management can be incredibly profitable if your winners are bigger than your losers. And with a 5.42% ROI, clearly the math works.

Performance Deep Dive

The Good: What's Working

Fee Efficiency is Stellar - At just 0.262% of total volume, we're keeping costs incredibly low. For context, many retail traders pay 0.5-1% in fees alone. On a $900K volume, saving even 0.25% means an extra $2,250+ in pocket. This is algorithmic trading at its finest - precise execution, minimal slippage, optimal order routing.

LINK Has Been Our Alpha Generator - With 34,496 trades (33.5% of all activity) and a modest but consistent $49.25 profit, LINK has proven to be the perfect asset for our high-frequency approach. The liquidity is there, the volatility is manageable, and the spreads are tight enough to scalp consistently.

Volume Tells the Real Story - $904K+ in volume over 294 days means we're actively managing capital, not letting it sit idle. In crypto, capital efficiency is king. Every dollar that's actively working is a dollar that can compound.

The Diversification Play - Trading 21 different assets isn't just about spreading risk; it's about capturing opportunities across the entire market. When BTC consolidates, altcoins often make moves. When majors pump, small caps get their turn. Our system is positioned to catch these rotations.

The Strategic Wins

Let's talk about the standout performers:

LTC delivered $4,888.63 in profits - Classic Litecoin, often overlooked but consistently profitable. Our 4,082 trades captured those sweet momentum moves.

SHIB surprised with $5,439.90 - Yes, a memecoin in the top performers. But here's the thing: high volatility + tight spreads + large retail participation = scalping opportunities. The algorithm doesn't care about narratives; it cares about price action.

DASH contributed $4,278.29 - Privacy coins have their moments, and we captured several of them. The relatively lower competition in these pairs can lead to better fills.

BTC netted $5,407.18 - Even with just 3,121 trades, Bitcoin proved profitable. This is the "steady Eddie" of the portfolio.

UNI brought in $1,068.80 - DeFi tokens have been recovering, and our 19,974 trades on UNI (19.4% of all trades) caught that wave.

The Reality Check

Not everything is sunshine and rainbows. Let's address the elephants in the room:

SOL Underperformed - Down $1,209.06 despite 3,944 trades. Solana has been volatile this year, and our strategy may have gotten chopped up in some of its violent swings. This is an area we're analyzing for the upcoming ZephirexCORE improvements.

ATOM Showed a Small Loss - Negative $101.66 on 4,260 trades. When you're executing hundreds of trades, sometimes the math doesn't work out on certain pairs. The key is that these losses are contained and don't blow up the account.

Win Rate Isn't Sky-High - With 44.3% of active days showing positive flow, we're basically flipping coins, right? Wrong. In trading, a 44% win rate with proper risk management can be incredibly profitable if your winners are bigger than your losers. And with a 5.42% ROI, clearly the math works.

Trading Activity Breakdown

Top 5 Most Traded Assets

Asset Number of Trades % of Total Net P&L Fees Paid

LINK 34,496 33.5% $49.25 $1,034.94

UNI 19,974 19.4% $1,068.80 $292.43

ADA 12,610 12.3% $211.73 $183.69

DASH 5,566 5.4% $4,278.29 $102.12

ETH 4,514 4.4% $968.29 $120.56

The LINK Story Deserves Special Mention

33.5% of all trades went through LINK. That's over a third of our entire operation focused on one asset. Why?

Liquidity: LINK has deep order books on multiple pairs (LINK-BTC, LINK-ETH, LINK-USD)

Volatility: Enough movement to profit from, but not so wild it becomes unpredictable

Correlation Plays: LINK moves with its own rhythm, not always following BTC/ETH

Spread Efficiency: Tight bid-ask spreads mean we can get in and out cleanly

The $49.25 profit might seem small for 34,496 trades, but here's the perspective: after paying $1,034.94 in fees, we're still green. And that consistency - day after day, week after week - is what compounds.

Trading Activity Breakdown

Top 5 Most Traded Assets

Asset Number of Trades % of Total Net P&L Fees Paid

LINK 34,496 33.5% $49.25 $1,034.94

UNI 19,974 19.4% $1,068.80 $292.43

ADA 12,610 12.3% $211.73 $183.69

DASH 5,566 5.4% $4,278.29 $102.12

ETH 4,514 4.4% $968.29 $120.56

The LINK Story Deserves Special Mention

33.5% of all trades went through LINK. That's over a third of our entire operation focused on one asset. Why?

Liquidity: LINK has deep order books on multiple pairs (LINK-BTC, LINK-ETH, LINK-USD)

Volatility: Enough movement to profit from, but not so wild it becomes unpredictable

Correlation Plays: LINK moves with its own rhythm, not always following BTC/ETH

Spread Efficiency: Tight bid-ask spreads mean we can get in and out cleanly

The $49.25 profit might seem small for 34,496 trades, but here's the perspective: after paying $1,034.94 in fees, we're still green. And that consistency - day after day, week after week - is what compounds.

What The Numbers Really Mean

The Average Trade Size: $8.80

This is crucial. We're not swinging for the fences with $10K positions. We're executing small, precise trades. This approach:

Minimizes individual trade risk

Allows rapid position adjustments

Reduces exposure to sudden market moves

Enables high-frequency opportunity capture

352 Trades Per Day

Yes, you read that right. The algorithm is making decisions and executing trades roughly every 4 minutes during active trading (assuming ~24-hour market). This is impossible for humans. This is where automation shows its true value.

56.8% Market Participation

We're not trading every single day. The algorithm is selective, waiting for the right setups. 167 out of 294 days showed activity, meaning we're sitting out during low-opportunity periods. This discipline prevents overtrading and preserves capital.

What The Numbers Really Mean

The Average Trade Size: $8.80

This is crucial. We're not swinging for the fences with $10K positions. We're executing small, precise trades. This approach:

Minimizes individual trade risk

Allows rapid position adjustments

Reduces exposure to sudden market moves

Enables high-frequency opportunity capture

352 Trades Per Day

Yes, you read that right. The algorithm is making decisions and executing trades roughly every 4 minutes during active trading (assuming ~24-hour market). This is impossible for humans. This is where automation shows its true value.

56.8% Market Participation

We're not trading every single day. The algorithm is selective, waiting for the right setups. 167 out of 294 days showed activity, meaning we're sitting out during low-opportunity periods. This discipline prevents overtrading and preserves capital.

Behind The Scenes: The Trading Pairs Strategy

Looking at the transaction logs reveals something interesting: we're not just trading COIN-USD pairs. We're executing triangular arbitrage and cross-pair opportunities:

LINK-BTC, LINK-ETH, LINK-USD

SOL-BTC, SOL-ETH, SOL-USD

ADA-ETH, ADA-USD

This multi-pair approach allows us to:

Capture price inefficiencies between exchanges/pairs

Reduce reliance on any single pair's liquidity

Navigate around temporary liquidity crunches

Optimize fee structures (BTC pairs vs stablecoin pairs)

Behind The Scenes: The Trading Pairs Strategy

Looking at the transaction logs reveals something interesting: we're not just trading COIN-USD pairs. We're executing triangular arbitrage and cross-pair opportunities:

LINK-BTC, LINK-ETH, LINK-USD

SOL-BTC, SOL-ETH, SOL-USD

ADA-ETH, ADA-USD

This multi-pair approach allows us to:

Capture price inefficiencies between exchanges/pairs

Reduce reliance on any single pair's liquidity

Navigate around temporary liquidity crunches

Optimize fee structures (BTC pairs vs stablecoin pairs)

Key Insights & Learnings

1. Consistency > Home Runs

The standout lesson from 294 days of data: boring consistency compounds. We're not looking for 10x overnight. We're grinding out 0.01% here, 0.05% there, and it adds up to 5.42% realized returns.

2. Fee Management is Profit

Keeping fees at 0.26% of volume is a huge competitive advantage. Many traders focus solely on entry/exit strategy while ignoring fees. Over $900K in volume, every basis point counts.

3. Diversification Works (Mostly)

21 assets provided multiple profit centers. When one pair underperforms (looking at you, SOL), others pick up the slack. However, too much diversification can dilute focus - a balance we're refining.

4. High-Frequency Requires Infrastructure

102,827 trades don't execute themselves. This requires:

Robust API connections

Real-time data feeds

Low-latency execution

24/7 uptime monitoring

Automated error handling

5. The Market Doesn't Sleep, But Your Strategy Should

44.3% win rate on active days reminds us: not every day is a trading day. The algorithm recognizes when conditions aren't favorable and steps aside. This prevents the classic retail mistake of forcing trades.

Key Insights & Learnings

1. Consistency > Home Runs

The standout lesson from 294 days of data: boring consistency compounds. We're not looking for 10x overnight. We're grinding out 0.01% here, 0.05% there, and it adds up to 5.42% realized returns.

2. Fee Management is Profit

Keeping fees at 0.26% of volume is a huge competitive advantage. Many traders focus solely on entry/exit strategy while ignoring fees. Over $900K in volume, every basis point counts.

3. Diversification Works (Mostly)

21 assets provided multiple profit centers. When one pair underperforms (looking at you, SOL), others pick up the slack. However, too much diversification can dilute focus - a balance we're refining.

4. High-Frequency Requires Infrastructure

102,827 trades don't execute themselves. This requires:

Robust API connections

Real-time data feeds

Low-latency execution

24/7 uptime monitoring

Automated error handling

5. The Market Doesn't Sleep, But Your Strategy Should

44.3% win rate on active days reminds us: not every day is a trading day. The algorithm recognizes when conditions aren't favorable and steps aside. This prevents the classic retail mistake of forcing trades.

What's Next: ZephirexCORE Dashboard

Here's what I'm excited to share: we're currently testing and developing ZephirexCORE, a comprehensive dashboard that will bring unprecedented transparency and control to automated trading.

Target Release: January 9, 2026

What's Next: ZephirexCORE Dashboard

Here's what I'm excited to share: we're currently testing and developing ZephirexCORE, a comprehensive dashboard that will bring unprecedented transparency and control to automated trading.

Target Release: January 9, 2026  79 days, 11 hours, 4 minutes, 24 seconds until launch (as of this writing).

What's Coming in ZephirexCORE:

Real-Time Analytics

Live equity curve visualization

Asset-level performance breakdowns

Fee tracking and optimization insights

Risk exposure monitoring

Trade execution logs with millisecond precision

Enhanced Risk Management (The Big One)

This is the major focus area for the release. Based on lessons from the past 294 days:

Dynamic Position Sizing - Automatically adjusting trade sizes based on recent volatility and account equity

Asset-Level Stop Losses - Implementing individual asset drawdown limits (hello, SOL loss containment)

Correlation-Based Diversification - Ensuring we're not over-exposed to correlated moves

Volatility Filters - Pausing trading on assets experiencing abnormal volatility spikes

Maximum Daily Loss Limits - Circuit breakers to protect against catastrophic days

Profit Protection - Automatically scaling back after significant gains to preserve profits

Monthly Performance Tracking

The dashboard will include granular month-over-month breakdowns, making it easy to spot seasonal trends and optimization opportunities.

The "Indian Score" Metric

For those who caught it in the screenshot - yes, we're tracking a proprietary Indian Score (+21.31% currently). This is a composite metric combining multiple factors including risk-adjusted returns, consistency, and capital efficiency. More details on this at launch.

Why The Wait Until January?

Testing, testing, testing. The current analysis you're reading is being manually compiled from raw Coinbase data. The dashboard needs to:

Handle real-time data ingestion without lag

Properly calculate all metrics (as evidenced by this deep dive, there's a lot of moving parts)

Provide accurate historical reconstruction

Integrate with multiple exchange APIs

Include robust error handling

We're not rushing this to market. When ZephirexCORE launches, it needs to be bulletproof.

79 days, 11 hours, 4 minutes, 24 seconds until launch (as of this writing).

What's Coming in ZephirexCORE:

Real-Time Analytics

Live equity curve visualization

Asset-level performance breakdowns

Fee tracking and optimization insights

Risk exposure monitoring

Trade execution logs with millisecond precision

Enhanced Risk Management (The Big One)

This is the major focus area for the release. Based on lessons from the past 294 days:

Dynamic Position Sizing - Automatically adjusting trade sizes based on recent volatility and account equity

Asset-Level Stop Losses - Implementing individual asset drawdown limits (hello, SOL loss containment)

Correlation-Based Diversification - Ensuring we're not over-exposed to correlated moves

Volatility Filters - Pausing trading on assets experiencing abnormal volatility spikes

Maximum Daily Loss Limits - Circuit breakers to protect against catastrophic days

Profit Protection - Automatically scaling back after significant gains to preserve profits

Monthly Performance Tracking

The dashboard will include granular month-over-month breakdowns, making it easy to spot seasonal trends and optimization opportunities.

The "Indian Score" Metric

For those who caught it in the screenshot - yes, we're tracking a proprietary Indian Score (+21.31% currently). This is a composite metric combining multiple factors including risk-adjusted returns, consistency, and capital efficiency. More details on this at launch.

Why The Wait Until January?

Testing, testing, testing. The current analysis you're reading is being manually compiled from raw Coinbase data. The dashboard needs to:

Handle real-time data ingestion without lag

Properly calculate all metrics (as evidenced by this deep dive, there's a lot of moving parts)

Provide accurate historical reconstruction

Integrate with multiple exchange APIs

Include robust error handling

We're not rushing this to market. When ZephirexCORE launches, it needs to be bulletproof.

The Road Ahead

Short-Term (Next 79 Days)

SOL Strategy Refinement - The $1,209 loss isn't acceptable. We're analyzing whether it's a strategy issue, a volatility issue, or a pair-specific problem.

Fee Optimization - Already at 0.26%, but can we push it lower? Exploring maker/taker fee structures and order type optimization.

LINK Position Enhancement - It's our highest volume pair. Small improvements here have outsized impacts.

Risk Management Integration - Building out the systems that will power ZephirexCORE's enhanced risk controls.

Medium-Term (Q1-Q2 2026)

Scale Testing - Can we maintain 5%+ ROI if we 2x the capital? 5x? Understanding our scaling limits.

Additional Asset Expansion - 21 assets is good, but are there untapped opportunities in newer listings or less-traded pairs?

Market Regime Detection - Teaching the algorithm to recognize bull vs. bear vs. sideways markets and adjust accordingly.

Long-Term Vision

The goal isn't just profitable trading. It's building a systematic, scalable, transparent trading infrastructure that can:

Adapt to changing market conditions

Scale with capital growth

Provide real-time insights to operators

Implement institutional-grade risk management

Generate consistent, compounding returns

The Road Ahead

Short-Term (Next 79 Days)

SOL Strategy Refinement - The $1,209 loss isn't acceptable. We're analyzing whether it's a strategy issue, a volatility issue, or a pair-specific problem.

Fee Optimization - Already at 0.26%, but can we push it lower? Exploring maker/taker fee structures and order type optimization.

LINK Position Enhancement - It's our highest volume pair. Small improvements here have outsized impacts.

Risk Management Integration - Building out the systems that will power ZephirexCORE's enhanced risk controls.

Medium-Term (Q1-Q2 2026)

Scale Testing - Can we maintain 5%+ ROI if we 2x the capital? 5x? Understanding our scaling limits.

Additional Asset Expansion - 21 assets is good, but are there untapped opportunities in newer listings or less-traded pairs?

Market Regime Detection - Teaching the algorithm to recognize bull vs. bear vs. sideways markets and adjust accordingly.

Long-Term Vision

The goal isn't just profitable trading. It's building a systematic, scalable, transparent trading infrastructure that can:

Adapt to changing market conditions

Scale with capital growth

Provide real-time insights to operators

Implement institutional-grade risk management

Generate consistent, compounding returns

Lessons For The Community

Whether you're running your own bot or trading manually, here are the key takeaways:

1. Track Everything

You can't improve what you don't measure. Every trade, every fee, every metric matters.

2. Fees Are Silent Killers

0.26% vs 1% might not seem like much, but on $900K that's the difference between $2,369 and $9,000 in costs. Almost $7K straight to your bottom line.

3. Diversification ≠ diworsification

21 assets is manageable. 100 assets would be chaos. Find the balance.

4. Automate Emotions Away

352 trades per day is impossible manually. Even if it wasn't, you'd burn out in a week. Algorithms don't get tired, scared, or greedy.

5. Risk Management > Everything

The upcoming ZephirexCORE risk improvements are the most important development. Returns matter, but surviving to compound those returns matters more.

6. Capital Efficiency Beats Position Size

It's not about how much you hold—it's about how efficiently you deploy capital. Keeping lean positions and maintaining liquidity for new opportunities often outperforms being fully invested in stagnant holdings. Cash isn't lazy; it's patient.

Lessons For The Community

Whether you're running your own bot or trading manually, here are the key takeaways:

1. Track Everything

You can't improve what you don't measure. Every trade, every fee, every metric matters.

2. Fees Are Silent Killers

0.26% vs 1% might not seem like much, but on $900K that's the difference between $2,369 and $9,000 in costs. Almost $7K straight to your bottom line.

3. Diversification ≠ diworsification

21 assets is manageable. 100 assets would be chaos. Find the balance.

4. Automate Emotions Away

352 trades per day is impossible manually. Even if it wasn't, you'd burn out in a week. Algorithms don't get tired, scared, or greedy.

5. Risk Management > Everything

The upcoming ZephirexCORE risk improvements are the most important development. Returns matter, but surviving to compound those returns matters more.

6. Capital Efficiency Beats Position Size

It's not about how much you hold—it's about how efficiently you deploy capital. Keeping lean positions and maintaining liquidity for new opportunities often outperforms being fully invested in stagnant holdings. Cash isn't lazy; it's patient.

Community Questions I'm Expecting

Q: 5.42% ROI in 294 days? That's only ~6.7% annualized. Why not just hold?

A: Fair question. But this is realized P&L from active trading, not unrealized paper gains from hodling. We're generating cash flow that can be redeployed immediately, not waiting months/years hoping for appreciation. Also, holding means you're at full market risk 24/7. Our strategy adjusts constantly, maintains significant cash reserves for opportunities, and keeps position sizes manageable. It's about capital efficiency, not just returns.

Q: Why so many trades on LINK? Seems risky to concentrate.

A: Volume concentration ≠ risk concentration. Each individual trade is small. We're spreading risk across 34,496 separate executions, not putting all eggs in one LINK basket. Plus, the profit and fee numbers show it's working.

Q: Can you share the algorithm?

A: The strategy itself is proprietary, but the results are transparent. That's the point of ZephirexCORE - showing what's happening without exposing the secret sauce.

Q: What happens if the bot goes rogue?

A: Current implementation has multiple safety layers: API key restrictions, exchange-level position limits, and manual oversight. ZephirexCORE will add automated circuit breakers and kill switches.

Q: Are you taking investments / offering this as a service?

A: Not at this time. ZephirexCORE is being developed as a personal trading infrastructure tool. Once stable and proven, we may explore other options.

Community Questions I'm Expecting

Q: 5.42% ROI in 294 days? That's only ~6.7% annualized. Why not just hold?

A: Fair question. But this is realized P&L from active trading, not unrealized paper gains from hodling. We're generating cash flow that can be redeployed immediately, not waiting months/years hoping for appreciation. Also, holding means you're at full market risk 24/7. Our strategy adjusts constantly, maintains significant cash reserves for opportunities, and keeps position sizes manageable. It's about capital efficiency, not just returns.

Q: Why so many trades on LINK? Seems risky to concentrate.

A: Volume concentration ≠ risk concentration. Each individual trade is small. We're spreading risk across 34,496 separate executions, not putting all eggs in one LINK basket. Plus, the profit and fee numbers show it's working.

Q: Can you share the algorithm?

A: The strategy itself is proprietary, but the results are transparent. That's the point of ZephirexCORE - showing what's happening without exposing the secret sauce.

Q: What happens if the bot goes rogue?

A: Current implementation has multiple safety layers: API key restrictions, exchange-level position limits, and manual oversight. ZephirexCORE will add automated circuit breakers and kill switches.

Q: Are you taking investments / offering this as a service?

A: Not at this time. ZephirexCORE is being developed as a personal trading infrastructure tool. Once stable and proven, we may explore other options.

Final Thoughts

294 days. 102,827 trades. 21 assets. $23,862.47 profit.

These numbers tell a story of consistency, discipline, and the power of algorithmic trading done right. We're not promising moon shots or lambos. We're grinding out sustainable, repeatable profits while building infrastructure that will compound those returns over time.

The journey to ZephirexCORE's January 9th launch is part of that evolution. Better analytics, enhanced risk management, and real-time transparency will take this operation to the next level.

For those following along: the next 79 days will be critical. We're not just trading; we're building. The difference between good and great is often found in the details, and we're diving deep into those details.

To consistent profits, controlled risks, and the systematic approach to crypto trading!

Final Thoughts

294 days. 102,827 trades. 21 assets. $23,862.47 profit.

These numbers tell a story of consistency, discipline, and the power of algorithmic trading done right. We're not promising moon shots or lambos. We're grinding out sustainable, repeatable profits while building infrastructure that will compound those returns over time.

The journey to ZephirexCORE's January 9th launch is part of that evolution. Better analytics, enhanced risk management, and real-time transparency will take this operation to the next level.

For those following along: the next 79 days will be critical. We're not just trading; we're building. The difference between good and great is often found in the details, and we're diving deep into those details.

To consistent profits, controlled risks, and the systematic approach to crypto trading!  Disclaimer: This is a personal trading journal and analysis. Not financial advice. Cryptocurrency trading involves substantial risk. Past performance doesn't guarantee future results. Trade at your own risk.

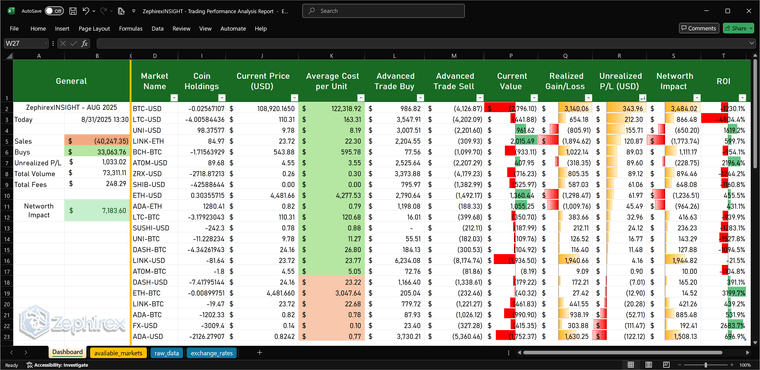

Dashboard Screenshot:

[ZephirexINSIGHT Dashboard showing the YTD performance metrics - Currently in testing/development phase]

Discussion Questions for the Community:

What's your take on the 0.26% fee efficiency - can it go lower?

Should we reduce LINK exposure or is 33.5% of volume acceptable given the performance?

Any ideas on improving the SOL strategy to prevent future losses?

What other metrics would you want to see in the ZephirexCORE dashboard?

Drop your thoughts below!

Disclaimer: This is a personal trading journal and analysis. Not financial advice. Cryptocurrency trading involves substantial risk. Past performance doesn't guarantee future results. Trade at your own risk.

Dashboard Screenshot:

[ZephirexINSIGHT Dashboard showing the YTD performance metrics - Currently in testing/development phase]

Discussion Questions for the Community:

What's your take on the 0.26% fee efficiency - can it go lower?

Should we reduce LINK exposure or is 33.5% of volume acceptable given the performance?

Any ideas on improving the SOL strategy to prevent future losses?

What other metrics would you want to see in the ZephirexCORE dashboard?

Drop your thoughts below!

-

RE: 🐺 Zephirex Trading Update: $17K+ Profit in 8 Months!Yuck yuck, sorry about the formatting. The forum has been updated and the old format style does not match the new format reader.

-

Undergoing Maintenance - 10/11 - 10/12We are working to upgrade our forum as the email system is no longer compatible with our sender and this forum would really like a good upgrade. Moreover, we are working diligently on https://insight.zephirex.com, feel free to check it out. Thank you for your patience in this matter, *- Zephirex Admin*

-

🐺 Zephirex Trading Update: $17K+ Profit in 8 Months!#

Zephirex Trading Update: $17K+ Profit in 8 Months!

---

##

Zephirex Trading Update: $17K+ Profit in 8 Months!

---

##  Another Successful Quarter in the Books!

Hey everyone! Zephirex here with my latest trading update. Just wrapped up my comprehensive analysis of my Coinbase trading activity from January through September 2025, and the results are pretty exciting to share with the community.

**TL;DR: +$17,925.75 profit with 10.65% ROI in 8 months**

Another Successful Quarter in the Books!

Hey everyone! Zephirex here with my latest trading update. Just wrapped up my comprehensive analysis of my Coinbase trading activity from January through September 2025, and the results are pretty exciting to share with the community.

**TL;DR: +$17,925.75 profit with 10.65% ROI in 8 months**  ---

##

---

##  The Numbers Don't Lie

Let me break down the key metrics from this period:

| Metric | Result |

|--------|--------|

| **Total Invested** | $168,298.64 |

| **Total Received** | $186,130.27 |

| **Realized P&L** | **+$17,925.75** |

| **ROI** | **10.65%** |

| **Trading Period** | 259 days |

| **Total Transactions** | 74,929 |

| **Assets Traded** | 17 different cryptos |

### What I'm Most Proud Of:

- **Fee Efficiency:** Only 0.35% of total volume went to fees

- **Consistent Performance:** 8 out of 9 months were profitable

- **Active Management:** Nearly 75K transactions shows I'm staying engaged

---

##

The Numbers Don't Lie

Let me break down the key metrics from this period:

| Metric | Result |

|--------|--------|

| **Total Invested** | $168,298.64 |

| **Total Received** | $186,130.27 |

| **Realized P&L** | **+$17,925.75** |

| **ROI** | **10.65%** |

| **Trading Period** | 259 days |

| **Total Transactions** | 74,929 |

| **Assets Traded** | 17 different cryptos |

### What I'm Most Proud Of:

- **Fee Efficiency:** Only 0.35% of total volume went to fees

- **Consistent Performance:** 8 out of 9 months were profitable

- **Active Management:** Nearly 75K transactions shows I'm staying engaged

---

##  The Big Winners

Here's where the alpha really showed up:

###

The Big Winners

Here's where the alpha really showed up:

###  Top 5 Performers:

1. **BTC:** +$5,323.58 (+224% gain)

Top 5 Performers:

1. **BTC:** +$5,323.58 (+224% gain)  2. **SHIB:** +$5,221.76 (the meme magic worked!)

3. **LTC:** +$4,448.24 (solid fundamentals paid off)

4. **DASH:** +$3,982.42 (privacy coins still have legs)

5. **FX:** +$1,304.46 (smaller position, solid returns)

The Bitcoin trades were absolutely fire this cycle. Got in early on some dips and the timing worked out perfectly.

---

##

2. **SHIB:** +$5,221.76 (the meme magic worked!)

3. **LTC:** +$4,448.24 (solid fundamentals paid off)

4. **DASH:** +$3,982.42 (privacy coins still have legs)

5. **FX:** +$1,304.46 (smaller position, solid returns)

The Bitcoin trades were absolutely fire this cycle. Got in early on some dips and the timing worked out perfectly.

---

##  My Trading Approach This Cycle

For those asking about strategy, here's what worked:

### Volume Distribution:

- **LINK:** $43,305.90 (25.7% of volume) - My biggest play

- **UNI:** $42,622.30 (25.3% of volume) - DeFi thesis paying off

- **ADA:** $24,218.89 (14.4% of volume) - Long-term holder here

### Trading Patterns:

- **Small, frequent trades:** Average buy size $4.16, sell size $5.46

- **Active rebalancing:** More buys than sells (54% vs 45%)

- **Fee conscious:** Kept fees super low relative to volume

---

##

My Trading Approach This Cycle

For those asking about strategy, here's what worked:

### Volume Distribution:

- **LINK:** $43,305.90 (25.7% of volume) - My biggest play

- **UNI:** $42,622.30 (25.3% of volume) - DeFi thesis paying off

- **ADA:** $24,218.89 (14.4% of volume) - Long-term holder here

### Trading Patterns:

- **Small, frequent trades:** Average buy size $4.16, sell size $5.46

- **Active rebalancing:** More buys than sells (54% vs 45%)

- **Fee conscious:** Kept fees super low relative to volume

---

##  Monthly Flow Analysis

Here's how each month played out:

| Month | Net P&L | Key Moves |

|-------|---------|-----------|

| **August** | +$7,582

Monthly Flow Analysis

Here's how each month played out:

| Month | Net P&L | Key Moves |

|-------|---------|-----------|

| **August** | +$7,582  | Best month - caught the summer rally |

| **May** | +$3,758 | Strong DeFi momentum |

| **March** | +$3,176 | Early year positioning paid off |

| **June** | +$2,254 | Steady accumulation phase |

| **January** | +$1,836 | Started the year right |

| **April** | +$1,270 | Mostly selling, taking profits |

| **July** | -$1,059

| Best month - caught the summer rally |

| **May** | +$3,758 | Strong DeFi momentum |

| **March** | +$3,176 | Early year positioning paid off |

| **June** | +$2,254 | Steady accumulation phase |

| **January** | +$1,836 | Started the year right |

| **April** | +$1,270 | Mostly selling, taking profits |

| **July** | -$1,059  | Only real red month - summer doldrums |

| **September** | -$504 | Light month, preparing for Q4 |

| **February** | -$388 | Minor pullback period |

That July dip was rough but staying disciplined and not panic selling made all the difference.

---

##

| Only real red month - summer doldrums |

| **September** | -$504 | Light month, preparing for Q4 |

| **February** | -$388 | Minor pullback period |

That July dip was rough but staying disciplined and not panic selling made all the difference.

---

##  What I Learned

### Key Insights:

1. **Bitcoin timing matters:** My BTC trades had exceptional returns

2. **Diversification works:** 17 assets helped spread risk

3. **Fee management is crucial:** Keeping costs low amplifies returns

4. **Stay active:** Regular rebalancing beat buy-and-hold this cycle

5. **Don't fear the memes:** SHIB was actually a top performer

### Areas for Improvement:

- **LINK concentration:** Maybe too heavy in one position

- **ETH underperformance:** Need to review my ETH strategy

- **Position sizing:** Could optimize entry/exit sizes better

---

##

What I Learned

### Key Insights:

1. **Bitcoin timing matters:** My BTC trades had exceptional returns

2. **Diversification works:** 17 assets helped spread risk

3. **Fee management is crucial:** Keeping costs low amplifies returns

4. **Stay active:** Regular rebalancing beat buy-and-hold this cycle

5. **Don't fear the memes:** SHIB was actually a top performer

### Areas for Improvement:

- **LINK concentration:** Maybe too heavy in one position

- **ETH underperformance:** Need to review my ETH strategy

- **Position sizing:** Could optimize entry/exit sizes better

---

##  Looking Ahead

With Q4 2025 approaching and the current market dynamics, I'm feeling bullish about continuing this momentum. The strategy is clearly working, and I'm seeing opportunities in:

- Layer 2 scaling solutions

- DeFi infrastructure plays

- Strategic BTC accumulation on dips

- Selective altcoin rotation

---

##

Looking Ahead

With Q4 2025 approaching and the current market dynamics, I'm feeling bullish about continuing this momentum. The strategy is clearly working, and I'm seeing opportunities in:

- Layer 2 scaling solutions

- DeFi infrastructure plays

- Strategic BTC accumulation on dips

- Selective altcoin rotation

---

##  Community Discussion

What do you all think about these results? Anyone else crushing it this cycle?

I'd love to hear:

- What's working in your portfolios?

- Any insights on the assets I'm holding?

- Thoughts on my trading frequency vs. HODLing?

Always looking to learn from this amazing community!

Community Discussion

What do you all think about these results? Anyone else crushing it this cycle?

I'd love to hear:

- What's working in your portfolios?

- Any insights on the assets I'm holding?

- Thoughts on my trading frequency vs. HODLing?

Always looking to learn from this amazing community!  ---

##

---

##  Final Thoughts

This has been an incredible period of growth both financially and as a trader. The key has been staying disciplined, managing risk, and not getting too greedy during the good times or too fearful during the rough patches.

Big shoutout to everyone here who's shared insights, market analysis, and kept the discussions flowing. This community is what makes navigating these markets so much better.

**Keep grinding, stay profitable, and let's make Q4 even better!**

Final Thoughts

This has been an incredible period of growth both financially and as a trader. The key has been staying disciplined, managing risk, and not getting too greedy during the good times or too fearful during the rough patches.

Big shoutout to everyone here who's shared insights, market analysis, and kept the discussions flowing. This community is what makes navigating these markets so much better.

**Keep grinding, stay profitable, and let's make Q4 even better!**

---

*P.S. - All numbers are from my actual Coinbase transaction history. This isn't financial advice, just sharing my journey with the fam!*

**Zephirex**

---

*P.S. - All numbers are from my actual Coinbase transaction history. This isn't financial advice, just sharing my journey with the fam!*

**Zephirex**  *Wolf of the Markets*

---

**Tags:** #trading #crypto #coinbase #portfolio #profits #bitcoin #altcoins #DeFi #results

*Wolf of the Markets*

---

**Tags:** #trading #crypto #coinbase #portfolio #profits #bitcoin #altcoins #DeFi #results

-

Pardon our mess, we are renewing everything.visit https://elite.zephirex.com for new site

-

🚀 Introducing the ZPX Token — Powered by ZephirexCORE## Why ZPX? ZPX isn’t just another token. It represents a **live investment opportunity** backed by **ZephirexCORE**, our 24/7 automated trading algorithm. We’ve reached a turning point where consistent profits are no longer just a vision — they’re becoming reality. [](https://app.uniswap.org/swap?inputCurrency=ETH&outputCurrency=0x3677537a47682e3346f5e24284b798637ef6d1e1) By holding ZPX, you’re not just buying a token, you’re joining a community aligned with **long-term algorithmic performance, transparency, and innovation.** --- ##

Transparent Performance

We’re preparing to roll out **real dashboards** using [Abacus.ai](https://abacus.ai) to display:

-

Transparent Performance

We’re preparing to roll out **real dashboards** using [Abacus.ai](https://abacus.ai) to display:

-  Automated trading metrics

-

Automated trading metrics

-  Portfolio growth

-

Portfolio growth

-  Historical P&L performance

-

Historical P&L performance

-  Liquidity and token holder stats

This means **investors can track results in real time** and see exactly how ZPX and ZephirexCORE are performing.

---

##

Liquidity and token holder stats

This means **investors can track results in real time** and see exactly how ZPX and ZephirexCORE are performing.

---

##  Why Now?

- Liquidity is already live on **Uniswap (ETH/ZPX pair)**

- Investors gain direct exposure to algorithmic trading gains + trading fee yield

- Community-focused growth built on transparency and technology

---

##

Why Now?

- Liquidity is already live on **Uniswap (ETH/ZPX pair)**

- Investors gain direct exposure to algorithmic trading gains + trading fee yield

- Community-focused growth built on transparency and technology

---

##  Join Us Early

This is just the beginning. As we grow, so does the potential upside for all holders.

Join Us Early

This is just the beginning. As we grow, so does the potential upside for all holders.

Swap your ETH for ZPX here: [Uniswap](https://app.uniswap.org/swap?inputCurrency=ETH&outputCurrency=0x3677537a47682e3346f5e24284b798637ef6d1e1)

Swap your ETH for ZPX here: [Uniswap](https://app.uniswap.org/swap?inputCurrency=ETH&outputCurrency=0x3677537a47682e3346f5e24284b798637ef6d1e1)

Start here: [forum.zephirex.com](https://forum.zephirex.com)

Start here: [forum.zephirex.com](https://forum.zephirex.com)

Learn more: [zephirex.com](https://zephirex.com)

Be part of the future of automated trading.

**Invest in ZPX. Invest in performance.**

Learn more: [zephirex.com](https://zephirex.com)

Be part of the future of automated trading.

**Invest in ZPX. Invest in performance.**

-

ZephirexCORE has been dully calibrated### Greetings! Entering a new era of trading, our optimized trading algorithm has acquired a new sense of precision, we've stripped all variables down to the bare bones to uncover the secrets of the universe, our algorithm now can adapt to drastic changes in the market beyond comprehension.    #### What does this mean? With the use of our newest dashboard, the analytics of our software has been more refined into the system it was designed to do *sniff out inefficiencies* in the market and target orders both defensively and offensively. Without giving away too many details, let's just say that our software is designed to maximize profits while limiting losses (by design). Thank you for staying up to date with our forum and feel free to share your insight into our latest discovery, and if you're also a trader who wants to gain the upper hand by extracting valuable data from your reports (fine-tune your markets just as we have), I invite you to become acquainted with the latest member of our team of robust trading analytics, ZephirexINSIGHT here: https://forum.zephirex.com/topic/61/available-now-new-improved-zephirexinsight-dashboard, with our new and improved version you can calibrate and better prepare for changes in the market. That is all, Juan B. Zephirex Technologies LLC Founder and CEO

-

🚀 Available Now - New & Improved ZephirexINSIGHT Dashboard#

Introducing the New & Improved **ZephirexINSIGHT** Dashboard

Tired of messy Coinbase CSV files? We’ve built the **ZephirexINSIGHT Excel Trading Dashboard** to transform raw exports into **clear, powerful analytics**—with **auto price updates** from the Coinbase public API.

Introducing the New & Improved **ZephirexINSIGHT** Dashboard

Tired of messy Coinbase CSV files? We’ve built the **ZephirexINSIGHT Excel Trading Dashboard** to transform raw exports into **clear, powerful analytics**—with **auto price updates** from the Coinbase public API.

**No private info needed** — secure by design.

**No private info needed** — secure by design.

Works directly with your Coinbase CSV files.

Works directly with your Coinbase CSV files.

Always up-to-date with current market prices.

---

##

Always up-to-date with current market prices.

---

##  What the Dashboard Tracks

### General Analytics

- Total purchased in USD (w/ fees)

- Total sold in USD (w/ fees)

- Total trading volume (USD)

- Total fees paid

### Per Market Data

- Coin holdings (positive or negative)

- Current price (auto-updated)

- Average cost per unit

- Total purchased (USD, w/ fees)

- Total sold (USD, w/ fees)

- Current holding value

- Realized profit/loss

- Unrealized profit/loss

- Networth impact in USD

- ROI %

---

##

What the Dashboard Tracks

### General Analytics

- Total purchased in USD (w/ fees)

- Total sold in USD (w/ fees)

- Total trading volume (USD)

- Total fees paid

### Per Market Data

- Coin holdings (positive or negative)

- Current price (auto-updated)

- Average cost per unit

- Total purchased (USD, w/ fees)

- Total sold (USD, w/ fees)

- Current holding value

- Realized profit/loss

- Unrealized profit/loss

- Networth impact in USD

- ROI %

---

##  Pricing & Launch Discount

- **Regular Price:** $37.99

- **Limited Time: 20% OFF with coupon [SEPT2025](https://ko-fi.com/zephirex/link/SEPT2025)**

Pricing & Launch Discount

- **Regular Price:** $37.99

- **Limited Time: 20% OFF with coupon [SEPT2025](https://ko-fi.com/zephirex/link/SEPT2025)**

[](https://ko-fi.com/s/b513de0aea)

---

[](https://ko-fi.com/s/b513de0aea)

---

Whether you’re a day trader, investor, or just need better clarity for taxes—**ZephirexINSIGHT** turns your Coinbase data into actionable insights.

***AI Generated Content***

Whether you’re a day trader, investor, or just need better clarity for taxes—**ZephirexINSIGHT** turns your Coinbase data into actionable insights.

***AI Generated Content***

-

Weekly report 7/11/2025 - BTC Comparison## Performance as compared with BTC-USD ### It's time to build a better future for yourself. So... here's a snapshot of BTCs current price change as a percentage, the highlighted section's blue label indicates a change of about +8.98% as of the last 7 days when the price shifted from ~$108k to ~$118k, let's check out the details.  ###

+9.51% is our increase this last week!

Our current portfolio has increased by +9.51% which is just 0.53 percentage points greater than our standard beloved BTC-USD market.

### What does this mean in terms of performance?

This is a tight race, we are only over by 0.53 percentage points which is slightly disappointing yet promising, we are managing to stay above the current market (for the week) and maintaining a steady 30-day volume.

Not only that, we are exceeding our profits, and have a more streamlined performance analysis that is currently tied to the percentage change of one of the most (if not the most) popular currencies in the market. This market is not as volatile as it once was, this provides a more steady baseline for generating fast and accurate performance reports for analysis and improving our software.

### Conclusion

Currently we are only mildly overtaking the rate of growth of Bitcoin, in the future we hope to perform **better** than its *losses* too, this is due to the asymmetry implanted in our blueprint by design, where -- as we always say -- we aim to maximize profits while minimize losses!

+9.51% is our increase this last week!

Our current portfolio has increased by +9.51% which is just 0.53 percentage points greater than our standard beloved BTC-USD market.

### What does this mean in terms of performance?

This is a tight race, we are only over by 0.53 percentage points which is slightly disappointing yet promising, we are managing to stay above the current market (for the week) and maintaining a steady 30-day volume.

Not only that, we are exceeding our profits, and have a more streamlined performance analysis that is currently tied to the percentage change of one of the most (if not the most) popular currencies in the market. This market is not as volatile as it once was, this provides a more steady baseline for generating fast and accurate performance reports for analysis and improving our software.

### Conclusion

Currently we are only mildly overtaking the rate of growth of Bitcoin, in the future we hope to perform **better** than its *losses* too, this is due to the asymmetry implanted in our blueprint by design, where -- as we always say -- we aim to maximize profits while minimize losses!