Hi all, today I want to share another detail I have observed when pulling our report for the YTD of 2022. Having just closed the first quarter -- our prerogative is to make sure that we are going into a successful 2nd quarter with low risk by consolidating some of the biggest gainers in the market.

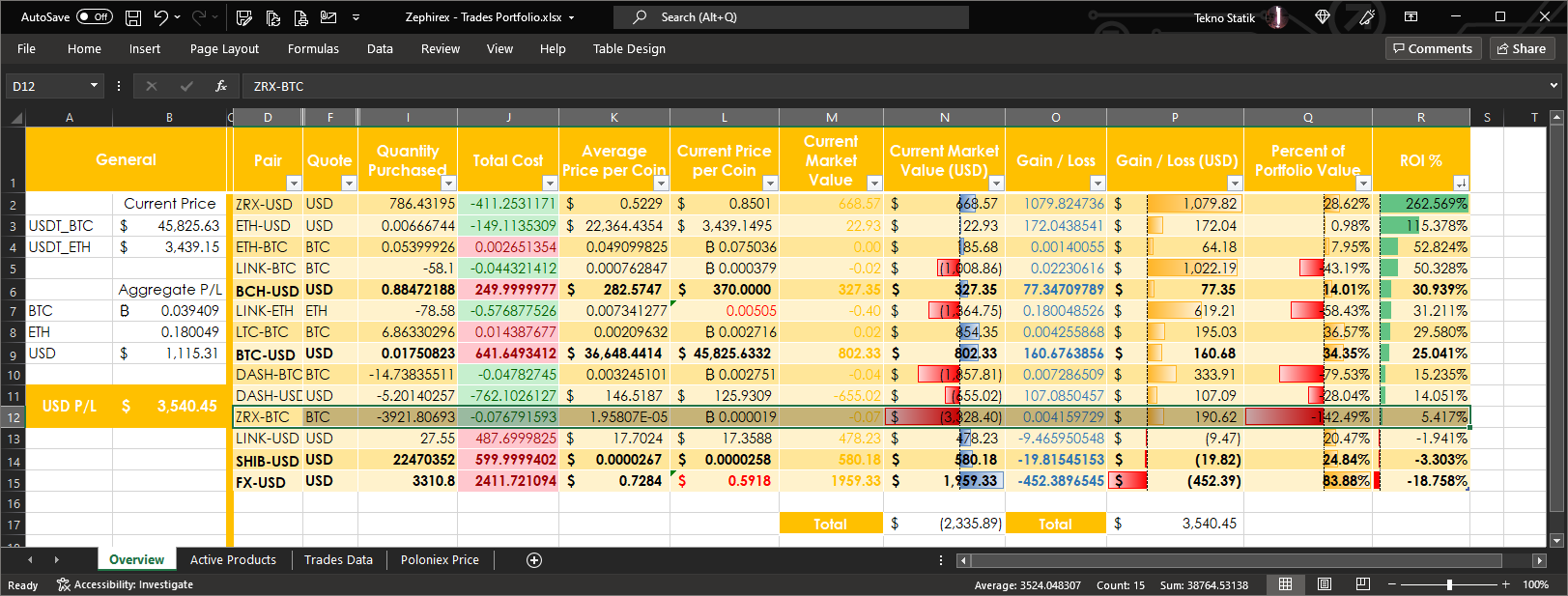

Little did we imagine that we would come across a pair that is relatively high in risk with a very small profit ($190 USD). So as indicated by the table below, we encounter a scenario where the ZRX-BTC pair is heavily invested and seemingly very hopeful of a downwards trend in the price of ZRX relative to BTC (See highlighted row below), this is commonly referred to as being bearish.

And with the most negative percent of portfolio value in USD (as pointed by column Q at -142%), we should first asses the situation to confirm if the market will indeed take a downturn to our advantage, or if we are locking ourselves into the potential for a greater loss.

It's hard to tell whether it is overpriced or not, and given how on another pair we have the biggest gain without a high risk, we would rather reduce the risk by 15% so that if we buy back at a lower price than our average it can also increase our average price per coin, so let's go ahead and make a purchase in BTC for 600 ZRX and increase from a -4000 to -3400 ZRX in quantity purchased. **Note,** this report can only see as far back as Jan 1st of 2022 so when taking into consideration the duration of the investment vs the amount of value at risk it is more practical to first reduce the risk than cutting a potentially greater loss in the near future.

### Excellent!

So from the time this article began to the time of the purchase the price came down by a small fraction; thus as our intention was to buy, then a lower price worked in our favor to increase our **average price per coin**. See our purchases below at 02:10:40

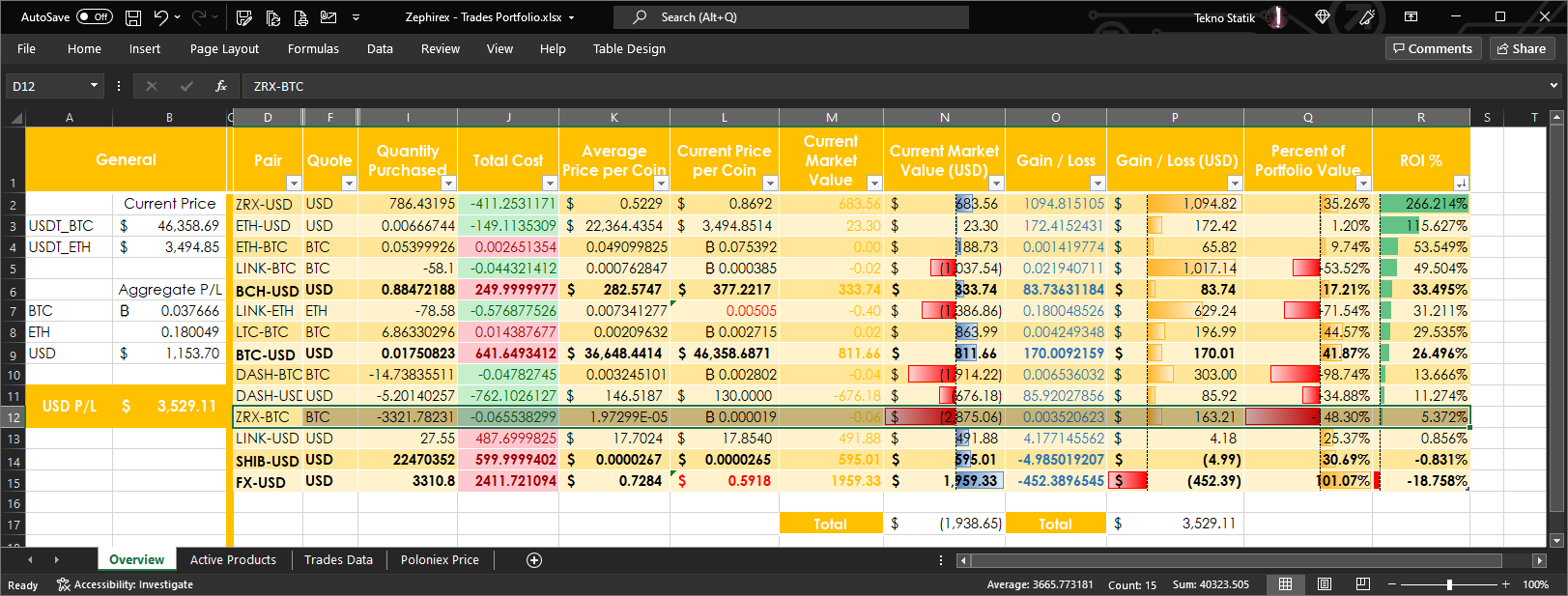

Now let's compare with the previous report and see if the changes applied to our balances are in accordance with what we expect these changes would reflect.

Not as fruitful as was expected, but the results can confirm nonetheless that our average was indeed raised by a negligible amount. Having done this does two things, reduces the loss if this pair continues to do great, and raises our average PPC as observed from the change in column K for each chart.

### Conclusion

The point of this article is to show how a simple buy or sell can be used to reduce a portfolio into becoming less of a risk, thus the only short-term regret would be leaning more towards not having bought back more ZPX if things go nicely on this pair. Since our **quantity purchased** is in the negative, this tells us that we have sold that amount from the start of the report's specified period.

*Disclaimer: This is not financial advice, please make your due diligence, study the markets first, and even consider seeking financial advice from a certified trading instructor before going into trading.*