## Presented: Opportunity

Hi all and welcome to the Zephirex report!

So here we have an interesting opportunity at changing the scales to our advantage. At this moment we can convert a heavy loss in terms of ROI into a lesser loss and a potential for profit, here's how:

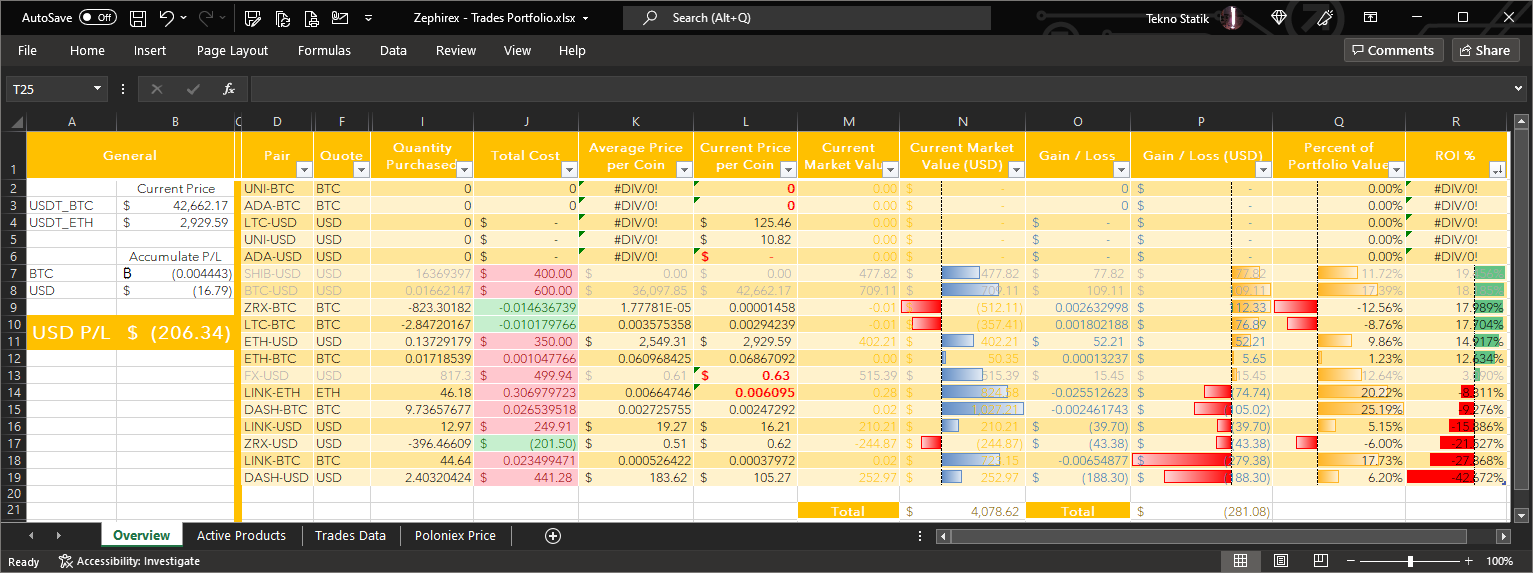

So we all know that ROI is determined by the amount lost **relative to** the amount invested, let's use this to our advantage on a pair that is relatively low on our portfolio (per column Q), observe columns Q and R below to see what I mean:

### The opportunity

Here we have a chance at changing our ROI into a smaller loss **relative to** ROI, thus leveraging the price to our advantage. Our report is generally based on a 30-day basis, therefore we can observe the last 30-day change in price for one of our heavier losses, *Note that the percent of portfolio value is relatively low*. Knowing this information, we are able to reduce our losses and actually leverage heavier on what is now a loss and turn it greatly into a potential win!

Above we note that there is a 26% loss over the past 30 days that we can extrapolate, so with our ROI at a greater loss (percentage-wise) than our observed 26% loss over the last 30 days we can see that a reversal is actually very likely to occur. Specifically because our portfolio shows that we have had a 42% loss over 6% of our portfolio, and this is negligible.

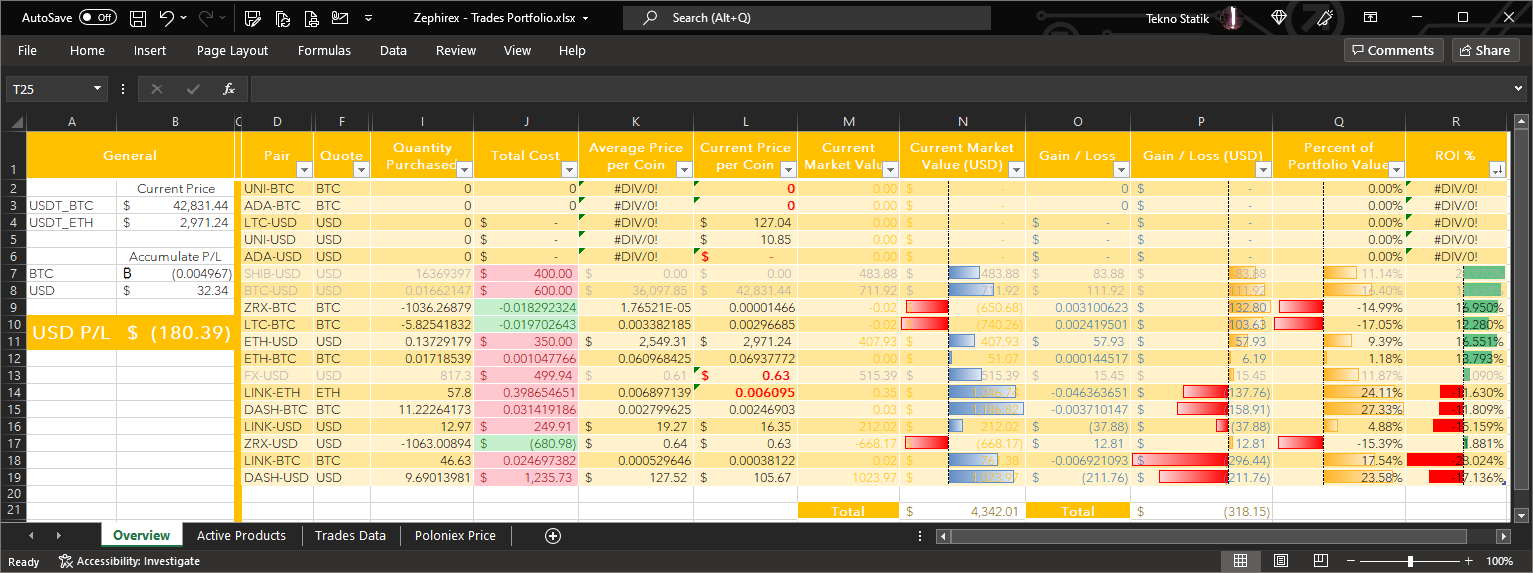

Not only that but we are so close to breaking the resistance at $105.62. Things are looking good, in terms of war this means that our bullish folk have lost greatly while we are also in a bullish position we have not lost so greatly and are in a position to change the tables around. Bears have had the market greatly over the last 30 days and are becoming seemingly weaker. This is a great chance to strike so heavy a blow that may actually change the outcome of this battle, and break through the upper resistance at $105.62.

In time our position at $105.62 will hopefully be sustained and a gain in the market is to be expected to arrive any time soon. Now with our current average in the market in a more beneficial place we can initiate a greater price change with a smaller volume.

And crazily enough, it looks like our position has benefited in two markets at once, the ZRX-USD and the DASH-USD markets, although, because of my automated trading algorithm and because of how low our Percent of Portfolio value was to begin with; we were more easily able to change the outcome of our ROI.

Thank you for reading, be sure to have a great day.